Alternatives to EDI for Automated PO Acknowledgements and Supplier Updates

.png?width=50&height=50&name=elizabeth-anderson-square%20(1).png)

7 Proven Alternatives to EDI for PO Acknowledgements in 2025

Electronic Data Interchange (EDI) remains foundational for structured B2B messaging, but it isn’t the only way—or even the fastest way—to automate purchase order (PO) acknowledgements and shipment updates in 2025. EDI’s strengths in standardization and compliance are clear, yet modern alternatives now cover the long tail of suppliers without costly mapping projects or new portals. In practice, you can achieve full supplier coverage with a mix of email-native automation, API networks, managed EDI, and collaboration platforms, unified in a single visibility layer. EDI is best understood as a protocol for machine-to-machine exchange of business documents like POs, ASNs, and invoices, often using agreed formats and transports such as AS2 and SFTP (see SAP’s overview of EDI fundamentals for context).

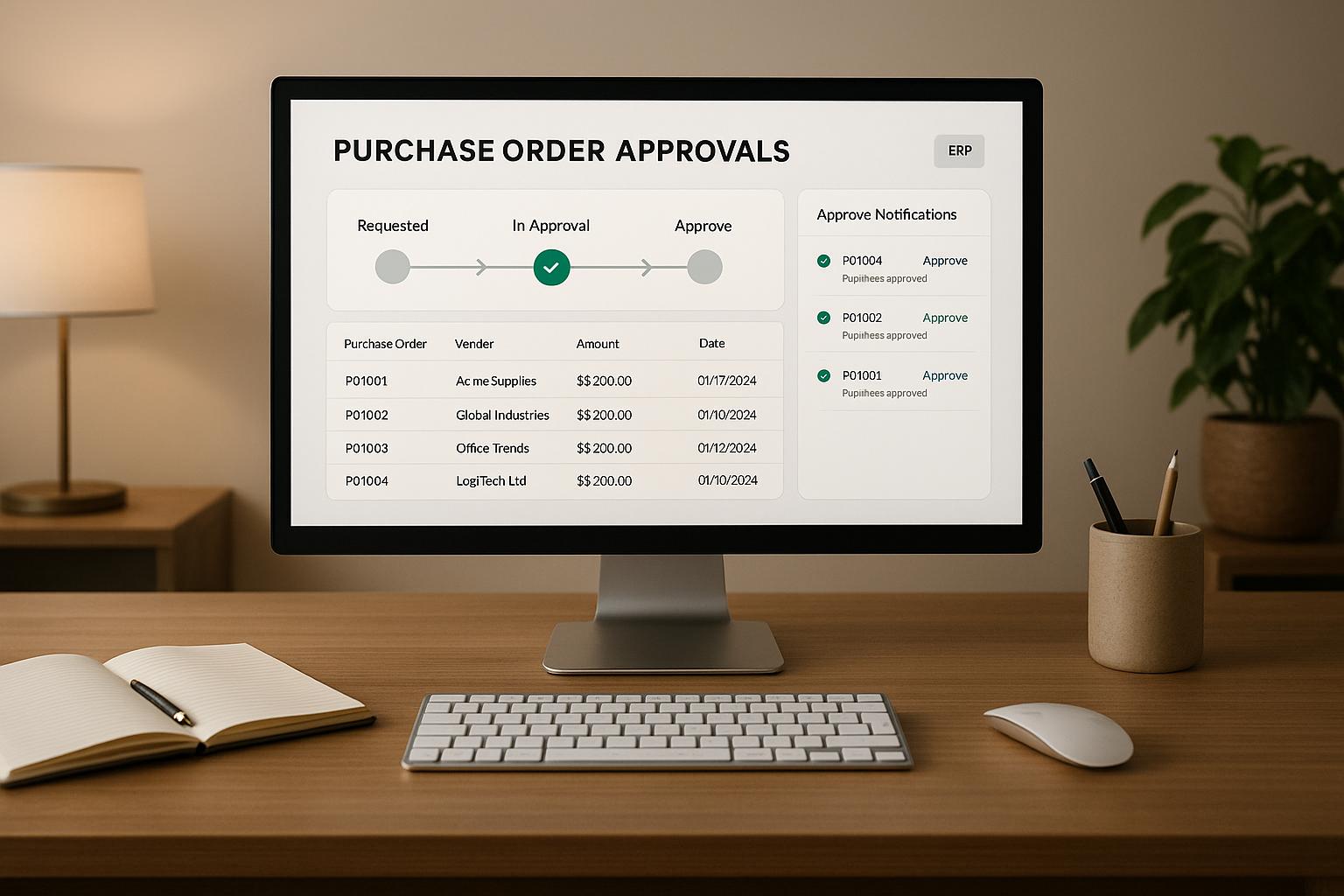

1. Leverage AI Supply Chain Control Tower

Leverage AI is a next-generation control tower designed to automate PO acknowledgements, shipment updates, supplier collaboration, and insights directly within your existing ERP—no rip-and-replace projects required. Teams cut manual work by 50% or more while accelerating supplier engagement, improving on-time, in-full (OTIF) delivery, and centralizing exception management.

A supply chain control tower is a cross-enterprise operations hub that consolidates PO and shipment signals, applies real-time exception detection, and orchestrates workflows across disparate systems and partners—covering both EDI and non-EDI channels—to drive faster, more reliable fulfillment decisions.

Leverage AI connects natively to your ERP, parses PDFs, spreadsheets, and emails with AI, and engages suppliers through multiple channels—including email-native automations and managed networks—so you receive unified, accurate PO status without imposing new logins or mandating EDI. Explore supported systems on Leverage AI’s integrations page for ERP coverage and deployment options.

Comparison snapshot

|

Approach |

Supplier Onboarding |

Internal Integration Effort |

Adoption Coverage |

Time-to-Value |

|---|---|---|---|---|

|

Leverage AI Control Tower |

Email-native, zero-login for long tail |

Light (ERP connector + rules) |

Near-100% (EDI + non-EDI) |

Weeks |

|

Legacy EDI |

High (per-partner mapping) |

High (custom maps, VANs) |

High-volume suppliers |

Months |

|

Supplier Portal |

Moderate (accounts, training) |

Medium (portal-ERP sync) |

Variable; often limited by login friction |

1–2 months |

|

API-Native Network |

Moderate (API onboarding) |

Medium (API integration) |

Strong for digital-ready suppliers |

Weeks–months |

2. Web EDI and Supplier Portal Solutions

Web EDI portals are browser-based interfaces where suppliers receive POs and send acknowledgements without deploying a traditional EDI stack—lowering technical barriers for low-volume vendors. In practice, web portals enable suppliers to receive POs and return acknowledgements without dedicated IT resources, offering fast digital onboarding and basic automation for the long tail, as summarized by Cleo’s overview of web EDI providers.

Typical features include PO receipt, PO acknowledgment (ACK) submission, simple status changes, and limited analytics. Portals are quick to deploy, but they seldom deliver deep exception automation, advanced analytics, or tight ERP integration. They also risk supplier resistance when login burdens and password resets stack up—an adoption hurdle frequently noted in supplier portal roundups for 2025 that emphasize onboarding ease, security, and analytics as key differentiators.

Limitations to consider:

-

Adoption friction when suppliers must maintain new credentials

-

Manual monitoring and reconciliation by internal teams

-

Less suitable for high complexity or multi-ERP environments

3. API-Native B2B Networks

An API-native B2B network is a centralized platform where you connect once via standardized APIs to exchange POs, acknowledgments, and updates with many partners—reducing custom mapping per supplier and accelerating onboarding.

Compared to legacy EDI, these networks compress mapping effort and shorten timelines by offering pre-configured transaction models and real-time validation. The result: fewer rejects, faster supplier activation, and more resilient flows across dynamic, multi-partner ecosystems. API-native options fit especially well when you need rapid partner additions, event-driven updates, and granular telemetry.

4. Cloud-Managed EDI Platforms

Cloud-managed EDI delivers end-to-end document processing as a subscription service, covering compliance checks, pre-built partner maps, change management, and vendor support. Pricing for platforms such as Cleo Integration Cloud is often subscription-based and reported to start around $1,000/month, varying with volume and modules, according to market roundups of EDI providers. Managed networks like TrueCommerce pre-configure maps for tens of thousands of partners and auto-update when formats change, validating common transaction sets (850, 855, 856, 810) before delivery—ideal for mid- to high-volume flows and retail compliance.

Cloud EDI options at a glance

|

Approach |

Strengths |

Trade-offs |

Best Fit |

|---|---|---|---|

|

Cloud-managed EDI |

Rapid partner activation, managed maps, compliance support |

Subscription costs, vendor dependence |

Retail, high-volume suppliers, compliance-heavy |

|

Hybrid (Control Tower + EDI) |

Unified visibility, flexible onboarding, selective EDI |

Coordination across tools |

Mixed supplier base, phased modernization |

|

Legacy On-Prem EDI |

Deep control, sunk-cost reuse |

High maintenance, slower onboarding |

Stable partner sets, strong in-house EDI team |

5. Integration Platform as a Service (iPaaS) Tools

iPaaS (integration platform as a service) connects ERPs, CRMs, supplier portals, and order systems via pre-built connectors and automation workflows, enabling data orchestration across EDI and non-EDI channels. Selection guides note that modern EDI stacks often converge with iPaaS capabilities—workflow routing, transformations, error handling, and dashboards—making iPaaS a strong backbone for cross-system PO acknowledgement flows.

Leading options (Celigo, MuleSoft/Anypoint, Jitterbit) automate routing of acknowledgements, normalize payloads, and centralize exceptions across multiple endpoints. iPaaS fits organizations that need real-time status visibility, advanced exception logic, and analytics without locking into a single transport or portal.

iPaaS vs Traditional EDI

-

Flexibility: iPaaS supports EDI, API, SFTP, and email-parsed data in one fabric; traditional EDI centers on EDI mappings and transports.

-

Analytics: iPaaS offers rich dashboards and event telemetry; traditional EDI typically requires add-ons.

-

Maintenance: iPaaS centralizes flows and scaling; traditional EDI increases maintenance per partner.

6. Supply Chain Collaboration Networks

Supply chain collaboration networks connect buyers, suppliers, and logistics providers in a shared digital ecosystem that automates document exchange, event tracking, and lifecycle workflows—moving beyond basic transport to coordinated execution. Platforms that offer end-to-end visibility and event-driven alerts, like those from project44, add predictive ETAs, inventory views, and cross-party collaboration that help teams manage exceptions before they escalate.

Compared to standalone portals or point EDI, these networks offer deeper orchestration and cross-functional adoption (procurement, logistics, quality). A typical PO acknowledgement flow:

-

Buyer issues PO and expected ship window

-

Supplier confirms quantities, dates, and substitutions

-

Exceptions trigger tasks, comments, and approvals

-

Shipment events update status and ETAs

-

Dashboard consolidates final ACK and delivery performance

7. Document Management and Translation Tools

Document management and translation solutions automate mapping, categorization, and matching of inbound/outbound documents with their acknowledgements, reprocess failures, and provide audit-ready visibility. They overlay legacy EDI or manual flows to speed exception handling and compliance reporting. Examples include “document journals” that auto-match 850-to-855 pairs and provide one-click reprocess/resend, reducing investigation time and chargeback risk. These tools are lightweight add-ons that produce outsized value in exception-prone or compliance-driven environments.

8. Managed Translation and VAN-Replacement Services

Managed translation and VAN-replacement services are cloud providers that handle protocol conversion (EDI, AS2, API, SFTP/FTP), partner compliance, and document delivery with clear SLAs and proactive monitoring—offering greater transparency and lower mapping overhead than classic VANs. They shine when you need:

-

Hybrid supplier connectivity without expanding internal EDI staff

-

Rapid partner additions and frequent format changes

-

Consistent error resolution, dashboards, and support SLAs

-

Bridge services during ERP or network migrations

How to Choose the Best Alternative to EDI for Your PO Acknowledgements

Start with an executive framework: optimize for supplier coverage, onboarding speed, adoption, and cost efficiency. Define PO acknowledgement as a supplier’s confirmation of quantities, prices, and dates; define total cost of ownership (TCO) as all-in spend across licenses, mappings, VAN/transaction fees, support, and change control; and measure onboarding speed from first outreach to the supplier’s first digital ACK.

Summary comparison for common scenarios

|

Method |

Supplier Volume Fit |

IT Readiness |

Visibility/Analytics |

Typical Onboarding Time |

|---|---|---|---|---|

|

Leverage AI Control Tower |

All, including long tail |

Low–medium |

High (unified dashboard) |

Weeks |

|

Web EDI/Portal |

Low–medium |

Low–medium |

Low–medium |

Weeks |

|

API-Native Network |

Medium–high |

Medium |

Medium–high |

Weeks–months |

|

Cloud-Managed EDI |

Medium–high |

Low–medium |

Medium–high |

1–3 months |

|

iPaaS |

All |

Medium–high |

High |

Weeks–months |

|

Doc Mgmt/Translation |

All (augmentation) |

Low |

Medium |

Days–weeks |

|

Managed Translation/VAN-Replace |

Medium–high |

Low |

Medium–high |

Weeks |

Evaluating Supplier Volume and Technical Readiness

Segment suppliers in a simple 2×2: volume (high/low) vs technical readiness (high/low). High-volume, high-readiness suppliers can justify EDI or an API network; the long tail benefits from email-native automation or web portals. The U.S. GSA, for example, restricts its EDI channel to vendors with at least 50 POs/month—underscoring the need for lighter options for low-volume partners.

Comparing Onboarding Speed and Total Cost of Ownership

Onboarding speed is the elapsed time from vendor outreach to the supplier’s first digital ACK. Consider TCO drivers: per-trading-partner setup fees, per-transaction charges, managed service tiers, and change-request costs. Analyst roundups note many EDI platforms bill per partner or transaction, which can inflate TCO at scale and should be modeled in forecasts.

Assessing Real-Time Visibility and Workflow Automation Needs

Prioritize solutions that centralize exceptions, provide audit trails, and trigger alerts when acknowledgements deviate from PO terms. Reviews praise Leverage AI for strong end-to-end visibility—a useful proxy for the level of operational telemetry you should expect in any platform. Aim for options (Leverage AI, iPaaS, collaboration networks) that unify multi-source updates into one dashboard.

Weighing Supplier Adoption and Collaboration Preferences

Supplier resistance to portals or complex integrations is common. Favor multi-channel methods—especially email-based automation and managed services—that meet suppliers where they already work to improve adoption and time-to-value. Use scorecards and feedback loops to monitor response times and continuously improve engagement.

Supplier Collaboration Without Portals: Best Practices and Alternatives

Portal-free collaboration means suppliers confirm, comment on, or update POs via familiar email while the system parses messages and attachments, validates data, and posts updates to your ERP automatically. This is where Leverage AI’s email-to-system workflows and multi-path engagement deliver the fastest coverage and the cleanest internal visibility for the long tail. For a deeper operational look at reducing manual follow-up work, see our guide to modern supplier engagement automation.

A simple email-based PO acknowledgement flow:

-

Buyer sends PO; system monitors a dedicated mailbox

-

Supplier replies with ACK in the email body or as PDF/XLS/TXT

-

AI parsing and validation extract line-level changes

-

Exceptions route to humans; clean updates post to ERP

-

Unified dashboard records status, SLAs, and audit trail

Leveraging Email-Based Automation for Seamless Supplier Communication

Email-based automation parses supplier replies and common attachments with OCR and AI, then routes validated updates into ERPs through workflow rules. Benefits include zero new logins, minimal training, and rapid onboarding—especially effective for the long tail. Mitigate format variability with AI-powered parsers and a human-in-the-loop for edge cases.

Balancing Supplier Ease with Internal PO Visibility

Keep suppliers in email while standardizing internal status. Integrate parsed updates into PO dashboards and supplier scorecards, enforce role-based access, and maintain audit trails for compliance. Review responsiveness and match rates monthly to fine-tune parsing rules and improve data reliability.

Combining Legacy EDI and Non-EDI Methods During Transitions

Adopt a hybrid model: retain EDI for high-volume partners and layer portals, email automation, or API networks for others. Use a unified exception queue, deduplicate across channels, and run phased pilots by supplier segment to minimize disruption and accelerate coverage.

Frequently Asked Questions

What are the most practical alternatives to EDI for PO acknowledgements?

Web portals, API-native B2B networks, cloud-managed EDI, iPaaS, supply chain collaboration networks, document translation tools, and email-based automation.

Can suppliers fully collaborate without adopting new portals?

Yes. Email-native automation and managed translation services let suppliers acknowledge and update POs via email, with systems posting updates automatically.

How do API-based integrations improve PO acknowledgement workflows?

They reduce mapping effort, validate data in real time, and speed partner onboarding by standardizing interactions across many suppliers.

Is email automation a reliable substitute for traditional EDI systems?

For low-to-medium volume suppliers, yes—if AI parsing and exception handling are robust and integrated with ERP updates and audit trails.

What factors should influence the decision to build versus buy a supplier portal?

Supplier volume, IT bandwidth, onboarding timelines, budget/TCO, required analytics, and projected supplier adoption rates.

.png?width=50&height=50&name=elizabeth-anderson-square%20(1).png)